Dartanboy

Citizen

- Joined

- May 10, 2022

- Messages

- 1,707

- Thread Author

- #1

Motion

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

MOTION FOR EMERGENCY INJUNCTION

The Department of Commerce has illegally seized Vanguard's assets, alleging illiquidity and an inability to pay back depositors. They immediately began attempting to forcibly liquidate assets and attempted to seize control of the entirety of Vanguard National Bank and Discover Bank.

These actions, if allowed to continue, will cause irreversible harm to the Plaintiff, in the form of forced liquidation of assets and an inability to operate the aforementioned banking institutions.

Thus, we ask that for the duration of this case:

- All seized assets remain frozen

- All seized businesses remain intact and non-dissolved

- The seized businesses be permitted to continue day-to-day business operations

Case Filing

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Vanguard & Co.

Plaintiff

v.

Commonwealth of Redmont

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

Vanguard & Co - a popular and law-abiding finance and banking company - was performing business as usual when the Department of Commerce suddenly seized their two banking institutions, Vanguard National Bank and Discover Bank. These seizures, along with announcements and actions around it, have violated the rights of the Plaintiff, defamed the Plaintiff, and caused immense harm to the Plaintiff.

The egregious and outrageous actions made by the Commonwealth must be met with the swift action of justice.

I. PARTIES

1. Vanguard & Co

2. Commonwealth of Redmont

II. FACTS

1. On May 15, 2025, at 10:39pm Central Time, the Department of Commerce announced a so-called Bank Holiday to prevent all banking activity for 36 hours [see Exhibit P-001].

2. On May 16, 2025, at 1:37am Central Time, the Department of Commerce lifted the so-called Bank Holiday and seized Vanguard National Bank and Discover Bank [see Exhibit P-002]. In the announcement of this, they made bold, false claims about Vanguard, including that the banks had “grave liquidity concerns” and “misrepresentation of financial statements” [see Exhibit P-002].

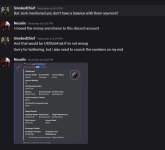

3. The Department of Commerce did not serve Vanguard a warrant nor did they properly initiate bankruptcy proceedings, and refused to mention it whenever confronted about it [see Exhibit P-003].

4. The Department of Commerce did not provide any evidence of insolvency until many hours later after arguing with Vanguard's lawyers, and even then, it was grossly insufficient and unconfirmed evidence provided by a 3rd party [see Exhibit P-004].

5. The Constitution gives every “citizen … the right to a … fair trial, presided over by an impartial Judicial Officer, and to be informed of the nature and cause of the accusation, and to be confronted with the evidence against them …” [see Constitution, Part IV, Section 9].

6. The Constitution gives every citizen the right to “life, liberty, and security of a person and not to be deprived thereof except in accordance with the principles of fundamental justice” [see Constitution, Part IV, Section 14].

7. The Constitution gives every citizen “the right to be secure against unreasonable search or seizure” [see Constitution, Part IV, Section 15].

8. The No More Defamation Act defines defamation as “Defamation is a false statement and/or communication that injures a third party's reputation. The tort of defamation includes both libel and slander” libel as “A method of defamation expressed by documents, signs, published media, or any communication embodied in physical form that is injurious to a person's reputation, exposes a person to public hatred, contempt or ridicule, or injures a person in his/her business, profession or organization” [see Act of Congress - No More Defamation Act]

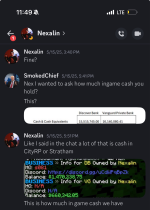

9. Public reaction to the announcement shows significant harm to Vanguard’s reputation [see Exhibit P-005].

10. The Government seized Vanguard’s in-game cash and assets on The Exchange [see Exhibit P-006, Exhibit P-007, Exhibit P-008, Exhibit P-009].

III. CLAIMS FOR RELIEF

1. Violation of the Right to a Fair Trial & Be Confronted With Evidence – By skipping any and all court proceedings and immediately seizing two banks without evidence to support their claims, Vanguard and its shareholders were denied the right to a Fair Trial and to be Confronted with the Evidence Against Them.

2. Violation of the Right to Life, Liberty, and Security – By seizing the life’s work of Nexalin and a significant amount of the shareholders’ interests, the security of these people was violated.

3. Violation of the Right to be Secure Against Unreasonable Seizure – By seizing the banks and millions of dollars worth of their assets without a warrant or court order, the Department of Commerce performed an Unreasonable Seizure.

4. Defamation (Libel) – The false statement declaring Vanguard’s illiquidity and misrepresentation of financial statements, and the illegal seizure of Vanguard’s banks, caused immense harm to Vanguard’s reputation.

5. Consequential Damages (Humiliation) – Vanguard has been disgraced, belittled, and made to look foolish by the Government creating a public spectacle of its seizure of Vanguard’s banks, and making bold, false claims that seriously negatively affected the bank’s reputation and operations.

6. Consequential Damages (Loss of Enjoyment) – Vanguard’s shareholders and Director have lost the ability to run the Vanguard banks, the very core of their gameplay for years.

7. Punitive Damages (Rights Violation 1) – Violating the Right to a Fair Trial is outrageous and warrants punitive damages.

8. Punitive Damages (Rights Violation 2) – Violating the Right to Life, Liberty, and Security is outrageous and warrants punitive damages.

9. Punitive Damages (Rights Violation 3) – Violating the Right to be Secure Against Unreasonable Seizure is outrageous and warrants punitive damages.

10. Punitive Damages (Defamation) – Defamation from Media Outlets is somewhat expected, albeit illegal, but from the Government, it is outrageous and warrants punitive damages.

11. Compensatory Damages (Seized Assets) – The seized assets are no longer able to accrue value through investment, creating compensatory damages.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. All seized businesses and assets be returned to the Plaintiff.

2. $1,000,000 for the immense reputational harm, likely to result in millions of deposits being withdrawn in a bank run.

3. $1,000,000 in Punitive Damages for violating the Right to a Fair Trial.

4. $1,000,000 in Punitive Damages for violating the Right to Life, Liberty, and Security.

5. $1,000,000 in Punitive Damages for violating the Right Against Unreasonable Seizure.

6. $50,000 in Humiliation Damages for creating a public spectacle of its seizure of Vanguard’s banks, and making bold, false claims that seriously negatively affected the bank’s reputation and operations (for some reason, $50k is the legal cap on this).

7. $50,000 for Loss of Enjoyment in Redmont for removing Vanguard’s shareholders’ and director’s way of life (again, for some reason $50k is the legal cap on this).

8. $1,000,000 in Punitive Damages for violating the No More Defamation Act and creating a public spectacle through its defamation of Vanguard.

9. $7,607,051.27 in Compensatory Damages (the value of the seized assets).

10. A public apology, detailing the illegal actions taken by the Government, clearing Vanguard of alleged wrongdoing, and explaining what steps the Department of Commerce will take to ensure they won’t seize businesses on made-up information in the future.

10. $3,812,115 (30% case value, rounded down to nearest dollar) in Legal Fees, payable to the in-game business JusticeCompass.

In Total:

1. All seized businesses and assets returned to the Plaintiff

2. $12,707,051.27 payable to Vanguard & Co.

3. A detailed public apology

4. $3,812,115 payable to Justice Compass, Ltd.

EVIDENCE

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 17th day of May 2025