EmmDubz

Citizen

- Joined

- Jun 11, 2025

- Messages

- 71

- Thread Author

- #1

Case Filing

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Vendeka Inc. & Pepecuu

Plaintiff

v.

Department of Commerce

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

WRITTEN STATEMENT FROM THE PLAINTIFF

This is a case for breach of contract and the Defendant's failure to adhere to its own crisis management policies. The Defendant, as the legal successor to the commandeered entity "The Exchange Inc.," defaulted on the repayment of the TEX-001 bonds held by the Plaintiffs.

Following the seizure, the Defendant published the "Financial Crisis Mitigation Plan," which created a distinct classification for the Plaintiffs as "Secured Creditors" based on their holding of "financial securities." The Defendant has since violated its own plan by improperly attempting to relegate the Plaintiffs' specific contractual claims to the State Owned Withdrawal Facility (SOWF), a separate process designed for depositors. The Plaintiffs seek to enforce their contractual rights and compel the Defendant to follow its own published rules.

I. PARTIES

1. Vendeka Inc. (Plaintiff)

2. Pepecuu (Plaintiff)

3. Department of Commerce (Defendant)

II. FACTS

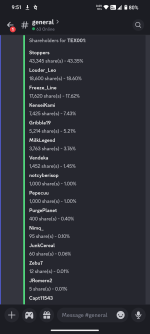

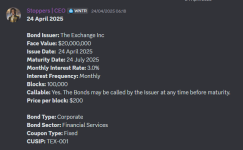

1. On April 24, 2025, The Exchange Inc. issued the "TEX-001" bonds, creating a binding loan contract with a mandatory maturity date of July 24, 2025. The Plaintiffs purchased a combined 2,452 units of these financial securities.

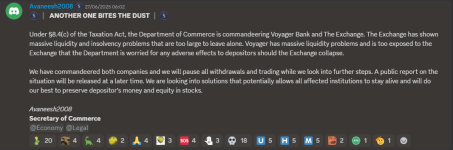

2. On June 27, 2025, the Defendant invoked its power under the Taxation Act to "commandeer" The Exchange Inc., choosing not to declare the entity bankrupt and thereby maintaining its legal continuity and inheriting its liabilities.

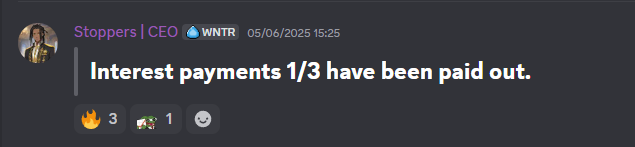

3. On the 5th of July 2025, and subsequently on the 5th of August, the second and third interest payments respectively were not paid out.

4. On July 13, 2025, the Defendant published the "Financial Crisis Mitigation Plan," which explicitly defined "Secured Creditors" to include entities holding "financial securities in the Exchange."

5. On July 24, 2025, while under the Defendant's direct control, the TEX-001 bonds reached their maturity date. The Defendant failed to repay the principal owed, constituting a material breach of contract.

6. In subsequent communications, the Defendant has contradicted its own Mitigation Plan by directing the Plaintiffs to the SOWF, a facility the plan reserves for "Depositors."

III. CLAIMS FOR RELIEF

1. The Defendant, as the successor-in-interest to The Exchange Inc., is liable for the material breach of the TEX-001 bond contract.

2. The Defendant is acting in an arbitrary manner by violating its own "Financial Crisis Mitigation Plan" and improperly classifying the Plaintiffs' claims.

IV. PRAYER FOR RELIEF

The Plaintiffs seeks the following from the Defendant:

1. $490,400 in compensatory damages, representing the principal value of 2,452 units of TEX-001 bonds at $200 per unit.

2. $29,424 in compensatory damages, representing two months of unpaid, accrued interest at the contractual rate of 3.0% per month.

3. $155,947.20 in legal fees, equalling 30% the compensatory damages.

V. EVIDENCE

1. P-001: The bond offering announcement for TEX-001.

2. P-002: An announcement from the Secretary of Commerce, dated the 27th of June 2025, confirming the commandeering of The Exchange.

3. P-003: The "Financial Crisis Mitigation Plan".

3. P-004: The "Voyager & The Exchange | Assessment of Health And Federal Seizure" report.

5. P-005: Proof of ownership of TEX-001 bonds for Vendeka Inc. & Pepecuu.

6. P-006: Transcript of DoC support ticket between Vendeka Inc. (EmmDubz) & the DoC.

7. P-007: First interest payment announcement.

Proof of Representation:

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 14th day of October 2025