Nacho

Manager

- Joined

- Jul 22, 2020

- Messages

- 1,131

- Thread Author

- #1

I request the court to put a stay on the outstanding warrant issued on or around February 17th against the Bank of Reveilles client information. The warrant provided misleading information from the Federal Reserve Board (FRB) to the Department of Justice, which, in turn, was provided to the court improperly. (P-2, p-3, p-4, p-5, p-6)

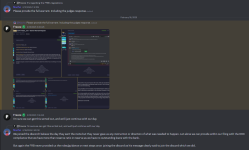

The Bank of Reveille was not asked to respond to the message from the FRB at the time it was sent (p-6), but the Department of Justice indicated within their warrant application that the bank has failed to comply and or take action, which is fundamentally false. A representative of the Bank of Reveille joined the FRB discord when the request was sent (P-5). The FRB failed to open a channel of communication within the FRB Discord to provide a process for providing the information requested.

Case Filing

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Bank of Reveille

Plaintiff

v.

Federal Reserve Bank (FRB)

Defendant

COMPLAINT

On February 17, 2025, at 3:33 pm Eastern Time, The Bank of Reveille was notified and provided a warrant issued by the Court within the Commonwealth of Redmont. The Bank of Reveille was provided a warrant by a representative of the Department of Justice. The information outlined to the court stipulated that the Bank of Reveille was non-compliant with the law. The DOJ noted that the bank did not respond or take action to comply. This information was fundamentally wrong. The Bank of Reveille sought further information from the Department of Justice regarding the warrant’s scope and nature. Upon being provided the information of the warrant, the Bank of Reveille was informed it was being pulled at the request of the Federal Reserve Bank (FRB) for being non-compliant with FRB policy ‘Bank Reserve Requirement Act.’

Within this case, we will want to look into the facts that the FRB is not given the authority to be an investigative authority, and the FRB is attempting to assume powers that are not expressly given to them within the Constitution or the Federal Reserve Act. The FRB is actively working to assume the powers given to that of the Department of Commerce.

The Department of Justice furthermore failed to do their due diligence on their own investigative work. Instead, they have pivoted their authority and taken a non-investigative body’s word for the alleged crimes. As a result, a warrant has been issued based on wrong information.

I. PARTIES

1. Federal Reserve Bank of Redmont (Defendant)

2. Stoppers (Reserve Governor)

3. Department of Justice (Witness)

4. Bank of Reveille (Plaintiff)

II. FACTS

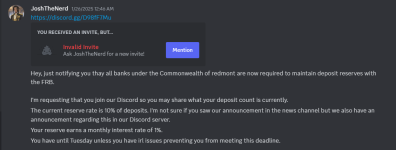

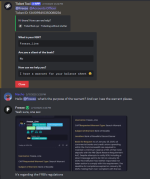

1. On January 26, 2025, at 12:46 AM EST, Reserve Governor Stoppers notified the Bank of Reveille and invited them to the Federal Reserve discord.

2. A Bank of Reveille representative joined the FRB discord on January 26, 2025, at 10:47 pm EST.

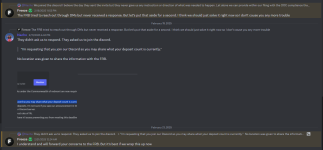

3. On the 17th of February, Attorney General Freeze_Line opened a support ticket to issue a search warrant for Bank of Reveille’s balance sheets.

4. On the 17th of February, The Bank of Reveille requested to view the warrant.

5. On the 18th of February, Bank of Reveille representatives notified the Attorney General of the clerical error of the warrants filing that the information presented was improper and that a Bank of Reveille representative did, in fact, join the FRB Discord.

6. On the 18th of February, The Attorney General ignored the indication of the clerical error in the warrants filing and still requested the information.

7. Evidence of the clerical error was provided to the Attorney General.

III. CLAIMS FOR RELIEF

1. The FRB has assumed authority expressly given to the Department of Commerce within the Commercial Standards Act.

2. The FRB has attempted to expand the authority expressed within the Federal Reserve Act.

3. The above actions have violated the Bank of Reveilles right of XIII. Every citizen is equal before and under the law and has the right to equal protection and equal benefit of the law without unfair discrimination and, in particular, without unfair discrimination based on political belief or social status.

4. The above actions have violated the Bank of Reveilles right of XIV. Every citizen has the right to life, liberty, and security of the person and the right not to be deprived thereof except in accordance with the principles of fundamental justice.

5. The above actions have violated the Bank of Reveilles right of XV. Every citizen has the right to be secure against unreasonable search or seizure.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. The Bank Reserve Requirement Act is struck as an overreach of authority.

2. Declaratory judgment on the scope and purpose of the Federal Reserve Bank.

3. Declaratory judgment on the scope and purpose of the Federal Reserve Bank policy initiatives.

4. Legal Fees - $5,000

By making this submission, I agree I understand the penalties of lying in court and that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 23 day of February 2025