- Joined

- Jul 1, 2025

- Messages

- 123

- Thread Author

- #1

Motion

IN THE DISTRICT COURT OF THE COMMONWEALTH OF REDMONT

MOTION TO EMERGENCY INJUNCTION

Your Honor the Plaintiff respectfully motions for an Emergency Injunction to freeze the transfer and prevent eviction by the DCT for the property R036. Emergency Injunctions in order to prevent government eviction in cases of collateral are nothing new and have been previously established in Redmont common law, the Plaintiff will cite [2025] FCR 100, [2025] FCR 108, and [2025] FCR 128.

Case Filing

IN THE DISTRICT COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

The Bank of Reveille

Plaintiff

v.

KingBob99878

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

The Bank of Reveille entered justly into a lending contract with the defendant. The Bank has fulfilled its obligations under the agreement and expects the defendant to do the same. The defendant has disregarded the Bank of Reveille's trust in declaring abandonment of the loan. While we have always stood firm and sought to avoid litigation, the bank believes the defendant has engaged in bad faith and wishes to collect the currently defaulted loan.

I. PARTIES

1. The Bank of Reveille

2. KingBob99878 (Defendant)

II. FACTS

(Comment: all dates are in MM/DD/YY format, additionally the timezone used is Eastern Standard Time or UTC-5)

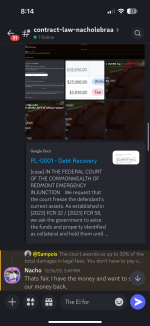

1. On or around 12/4/25, the Defendant notified the Bank of Reveille that they wished to take out a personal loan for $25,000 (

2. On or around 12/7/25, the Defendant notified the Bank of Reveille that they wished to move forward with the Loan Agreement provided to the Defendant on 12/4/25.

3. On or around 12/8/25, the Defendant was notified by a representative of the Bank of Reveille that funds had been wired to the Defendant and provided a screenshot to the Defendant of proof of transfer.

4. On or around 12/9/25, the defendant requested to modify the loan agreement for an adjustment to their repayment plan. The Bank of Reveille denied this request, reaffirmed the repayment structure, and referenced the agreement the Defendant signed.

5. On or around 12/16/25, 2 days past the deadline for the first payment on the loan, the Defendant was notified by an alternative bank representative of the past due payment and informed of the repercussions of a late fee as well as reporting of the missed payment

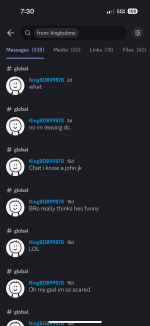

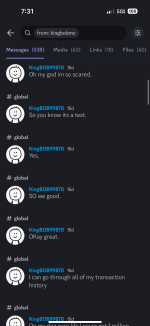

6. On or around 12/16/25, the Defendant notified the Bank of Reveille that they intend to leave DC. The bank understood this as a notification of a default on their outstanding obligations to repay the loan.

III. CLAIMS FOR RELIEF

1. Failure to Preform

The Defendant by announcing his leave from the server to the Plaintiff 2 weeks after payment was due, failing to inform the Plaintiff on how he intended on fulfilling his contractual obligations, and literally asking the Plaintiff to sue him he very clearly did not have any intention on paying back the loan.2. Collateral Transfer

Under the Contracts Act there exists a Duty to Good Faith and Fair Dealing where (to paraphrase) parties shall preform their expected duties in good faith and in a manner that is fair and just. As seen with both the amicus curiae brief as well as the DCT eviction thread the Defendant pretty undeniably transferred collateral not only in clear breach of good faith and preforming there duties in accordance with the Contracts Act but also with the effect of depriving the Plaintiff of there right to seize. IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

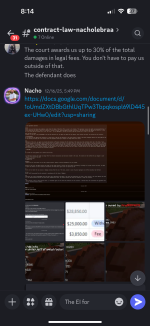

1. $28,850 in Compensatory Damages awarded to the plaintiff comprising $25,000 for the principal loan amount along with the $3,900 in accrued interest/Fees on the loan.

2. A court order to transfer ownership of the collateral (plot R036) over to the Plaintiff.

2. 30% of damages awarded in Legal Fees to Talion & Partners pursuant to the Legal Damages Act

Evidence:

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 16 day of December 2025

Last edited: