- Joined

- Apr 30, 2021

- Messages

- 76

- Thread Author

- #1

Good Evening, Your Honor

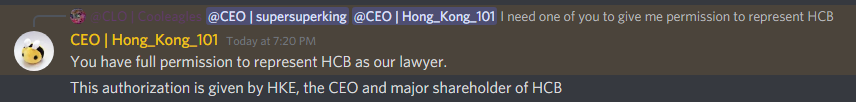

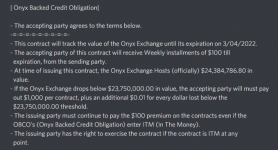

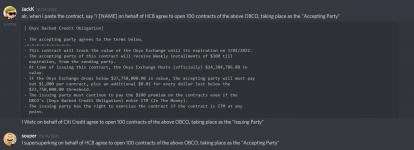

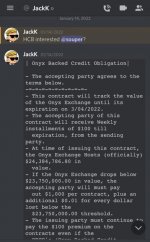

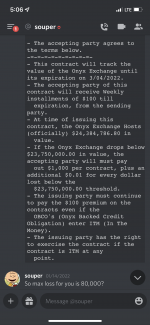

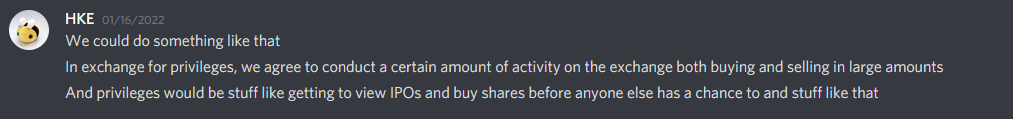

Before posting this case we must ask for an emergency injunction requesting firstly, that all information regarding the Onyx Backed Credit Obligation between Hamilton City Bank and JackK be allowed to be presented for the public eyes in this courtroom. An NDA signed by both parties prevents such information to be shared until an official subpoena and/or request is made by the government; moreover, this is us asking for such request to be made for this case. Secondly, we also request that all debt in regards to the Onyx Backed Credit Obligation between the two parties be halted until the completion of this case, as this will prevent my clients from paying any unnecessary debt, granted a favorable ruling is made. We apologize for the lack of information in this injunction, we simply are trying to best follow the terms given to us in our contract as possible. Of course, all facts will be made known in the Civil Complaint following this.

Thank you.

Before posting this case we must ask for an emergency injunction requesting firstly, that all information regarding the Onyx Backed Credit Obligation between Hamilton City Bank and JackK be allowed to be presented for the public eyes in this courtroom. An NDA signed by both parties prevents such information to be shared until an official subpoena and/or request is made by the government; moreover, this is us asking for such request to be made for this case. Secondly, we also request that all debt in regards to the Onyx Backed Credit Obligation between the two parties be halted until the completion of this case, as this will prevent my clients from paying any unnecessary debt, granted a favorable ruling is made. We apologize for the lack of information in this injunction, we simply are trying to best follow the terms given to us in our contract as possible. Of course, all facts will be made known in the Civil Complaint following this.

Thank you.