- Joined

- Sep 9, 2025

- Messages

- 41

- Thread Author

- #1

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Eddiegonza420 (Represented by guiltypleasurez of ObsidianLegal)

V.

Home Investment

Defendant

Home Investment, operated by Mapple24, solicited and accepted a significant deposit from the Plaintiff, offering professional investment services and assurances regarding the management and security of their funds. The Defendant has since failed to adhere to the terms of its own customer agreement, specifically by neglecting to provide the contractually obligated monthly updates on the portfolio's status.

Furthermore, the Defendant has ceased all communication with the Plaintiff, ignoring multiple attempts at contact. This abandonment of professional duty constitutes a severe breach of their contractual obligations and demonstrates an intent to permanently withhold the funds rightfully belonging to the Plaintiff. This conduct mirrors the actions for which the Defendant was previously found liable in Home Investment Clients Vs. Home Investment [2024] FCR 123.

I. PARTIES

The Plaintiff seeks the following relief from the Defendant:

DATED: This 10th day of September 2025

P-002

P-003

P-004

P-005

P-006

P-007

P-008

P-009

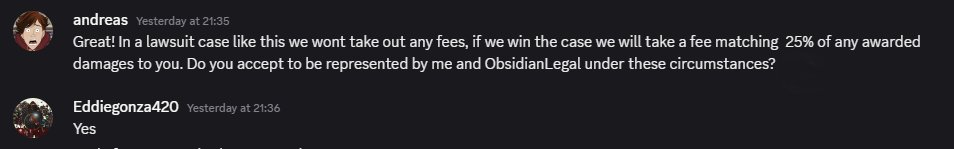

Proof of representation

CIVIL ACTION

Eddiegonza420 (Represented by guiltypleasurez of ObsidianLegal)

V.

Home Investment

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:Home Investment, operated by Mapple24, solicited and accepted a significant deposit from the Plaintiff, offering professional investment services and assurances regarding the management and security of their funds. The Defendant has since failed to adhere to the terms of its own customer agreement, specifically by neglecting to provide the contractually obligated monthly updates on the portfolio's status.

Furthermore, the Defendant has ceased all communication with the Plaintiff, ignoring multiple attempts at contact. This abandonment of professional duty constitutes a severe breach of their contractual obligations and demonstrates an intent to permanently withhold the funds rightfully belonging to the Plaintiff. This conduct mirrors the actions for which the Defendant was previously found liable in Home Investment Clients Vs. Home Investment [2024] FCR 123.

I. PARTIES

- Home Investment - Defendant.

- Mapple24 - Owner of Home Investment.

- Eddiegonza420 - Plaintiff.

- On or around August 7, 2024, the Plaintiff was solicited by the Defendant to invest funds (Exhibit P-001).

- On August 8, 2024, the Defendant provided the Plaintiff with a "CustomerAgreementDoc.pdf," to which the Plaintiff formally agreed (Exhibit P-002). The full text of this agreement is included as Exhibit P-009.

- Following the agreement, the parties discussed the final investment amount including the "loss proof plan" and the method of payment (Exhibit P-002 - P-005).

- On August 11, 2024, after receiving personal assurances from the Defendant (Exhibit P-006), the Plaintiff transferred $95,000 to the Defendant, which the Defendant confirmed receiving (Exhibit P-006).

- The customer agreement states, "Near the end of each month (usually), we will send you your portfolio data such as: - Your current portfolio balance - Money made/lost each month - Companies we invested in - General company updates" (Exhibit P-009).

- After an initial update on August 29, 2024, the Defendant failed to provide any subsequent monthly updates as required by the agreement (Exhibit P-007).

- The Plaintiff attempted to contact the Defendant for updates on April 22, 2025, and again on August 21, 2025, but received no response. The Defendant remains unresponsive (Exhibit P-008).

- The customer agreement states, "This contract is binding and if breached, an amount of $10,000 + 15% of deposited money will be paid to us" (Exhibit P-009). The court has previously ruled on the interpretation of this clause in Home Investment Clients Vs. Home Investment [2024] FCR 123 .

- The Defendant has failed to return the full amount of the funds that the Plaintiff deposited with Home Investment, retaining the full $95,000 without lawful basis or justification, and has not returned any funds (Exhibit P-006, Exhibit P-008).

- The Defendant's failure to provide monthly updates constitutes a clear breach of contract (Exhibit P-007 - Exhibit P-009). As established in Home Investment Clients Vs. Home Investment [2024] FCR 123, a reasonable interpretation of "us" in the contract's penalty clause refers to the Plaintiff, who is therefore owed $10,000 + 15% of the deposited amount (Exhibit P-009).

- The Plaintiff suffered emotional distress and loss of enjoyment due to the financial uncertainty and the Defendant's fraudulent behavior.

- The Plaintiff was deprived of the opportunity to invest their substantial funds elsewhere, losing significant potential income and growth due to Home Investment's wrongful retention of their money for over a year.

- The Plaintiff seeks punitive damages to deter Home Investment and others from engaging in similar predatory and fraudulent practices in the future, a pattern of behaviour established in Home Investment Clients Vs. Home Investment [2024] FCR 123 .

The Plaintiff seeks the following relief from the Defendant:

- The full return of the Plaintiff's invested funds, totaling $95,000.

- Payment of $10,000 due to the Defendant's breach of contract.

- Payment of 15% of the Plaintiff's deposit, totaling $14,250, as specified in the customer agreement for breach of contract.

- Payment of $25,000 in punitive damages to deter the Defendant from committing similar acts in the future.

- Payment of $20,000 for emotional distress caused by the Defendant's actions.

- Payment of $20,000 for loss of enjoyment resulting from the anxiety caused by the Defendant's fraudulent conduct.

- Payment of $46,063 in legal fees, representing 25% of the total damages sought ($184,250).

DATED: This 10th day of September 2025

EXHIBITS

P-001P-002

P-003

P-004

P-005

P-006

P-007

P-008

P-009

Proof of representation