- Joined

- May 4, 2021

- Messages

- 1,170

- Thread Author

- #1

IN THE DISTRICT COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

CraftyIso (Lovely Law Firm Representing)

Plaintiff

v

Chase Bank

Defendant

COMPLAINT

Your Honor, Chase Bank's interest rate is a 0.01% per month of money in the account. If you have $100 within the bank you earn 1 penny of interest every month. CraftyIso was a former banker at Chase Bank and thus can confirm in a Witness Testimony that Chase Bank had this amount of interest within their savings accounts. To withdraw your money from Chase Bank you have to pay a $50 fee on top of the withdrawal. So if you were to withdraw lets say $100 you will have to pay $50 on top of that. So in reality you would only be withdrawing $50 given the fee. In the Foundation of Contract Law (CLF and listed in Evidence A) it states that your contract must not "cause significant imbalance between the contractee's rights and obligations and those of the contractor". Given that Chase Bank was charging $50 per withdrawal at 0.01% interest per month this shows a clear disbalance which will be explored further in Claims for Relief.

I. PARTIES

1. CraftyIso (Plaintiff)

2. Chase Bank (Defendent)

II. FACTS

1. CraftyIso wanted to have a Savings Account to earn interest along with storing their money.

2. Chase Bank was the only option at the time of looking that did Savings Accounts for 0.1% a month.

3. CraftyIso signs an illegal contract with Chase Bank.

4. Megacorp opens their own bank at 5% interest a month Savings Account.

5. CraftyIso switches to Megacorp Banking for better interest.

6. CraftyIso states that the amount of interest at Chase Bank is "ass".

7. Chase Bank sues CraftyIso.

III. CLAIMS FOR RELIEF

1. The Defendant violated the CLF. The Defendant charged $50 per withdrawal with a limit of 2 withdrawals per week. Given they interest you would earn back was 0.01% this shows that even if you leave $300 inside the bank and withdraw $100 over 2 separate withdrawals you will have earned a penny whereas Chase Bank would earn $99.99. This shows heavy imbalance between the Signatory and the Contractor.

2. The Defendant violated the Corporate Law and Shareholder Protections Act (CLSP and listed in Evidence B). The Act states that you must not "intentionally engages in activity that undermines their duty or the integrity of the company". Given that the Defendant violated the CLSP this shows that they did not act with integrity and instead undermined the very company they were meant to keep the integrity of.

IV. PRAYERS FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. $3,000 (3k) in Compensation due to the violations of both laws.

2. $3,00 (3k) in Punitive Damages to help prevent other Banks from doing the same.

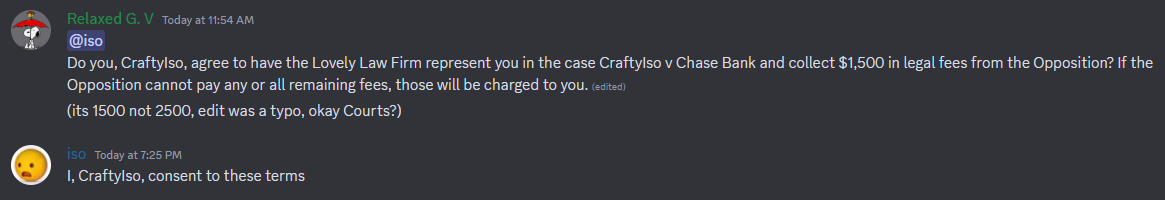

2. $1,500 (1.5k) in Legal Fees.

Evidence A

www.democracycraft.net

www.democracycraft.net

Evidence B

www.democracycraft.net

www.democracycraft.net

Proof of Representation.

CIVIL ACTION

CraftyIso (Lovely Law Firm Representing)

Plaintiff

v

Chase Bank

Defendant

COMPLAINT

Your Honor, Chase Bank's interest rate is a 0.01% per month of money in the account. If you have $100 within the bank you earn 1 penny of interest every month. CraftyIso was a former banker at Chase Bank and thus can confirm in a Witness Testimony that Chase Bank had this amount of interest within their savings accounts. To withdraw your money from Chase Bank you have to pay a $50 fee on top of the withdrawal. So if you were to withdraw lets say $100 you will have to pay $50 on top of that. So in reality you would only be withdrawing $50 given the fee. In the Foundation of Contract Law (CLF and listed in Evidence A) it states that your contract must not "cause significant imbalance between the contractee's rights and obligations and those of the contractor". Given that Chase Bank was charging $50 per withdrawal at 0.01% interest per month this shows a clear disbalance which will be explored further in Claims for Relief.

I. PARTIES

1. CraftyIso (Plaintiff)

2. Chase Bank (Defendent)

II. FACTS

1. CraftyIso wanted to have a Savings Account to earn interest along with storing their money.

2. Chase Bank was the only option at the time of looking that did Savings Accounts for 0.1% a month.

3. CraftyIso signs an illegal contract with Chase Bank.

4. Megacorp opens their own bank at 5% interest a month Savings Account.

5. CraftyIso switches to Megacorp Banking for better interest.

6. CraftyIso states that the amount of interest at Chase Bank is "ass".

7. Chase Bank sues CraftyIso.

III. CLAIMS FOR RELIEF

1. The Defendant violated the CLF. The Defendant charged $50 per withdrawal with a limit of 2 withdrawals per week. Given they interest you would earn back was 0.01% this shows that even if you leave $300 inside the bank and withdraw $100 over 2 separate withdrawals you will have earned a penny whereas Chase Bank would earn $99.99. This shows heavy imbalance between the Signatory and the Contractor.

2. The Defendant violated the Corporate Law and Shareholder Protections Act (CLSP and listed in Evidence B). The Act states that you must not "intentionally engages in activity that undermines their duty or the integrity of the company". Given that the Defendant violated the CLSP this shows that they did not act with integrity and instead undermined the very company they were meant to keep the integrity of.

IV. PRAYERS FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. $3,000 (3k) in Compensation due to the violations of both laws.

2. $3,00 (3k) in Punitive Damages to help prevent other Banks from doing the same.

2. $1,500 (1.5k) in Legal Fees.

Evidence A

Act of Congress - The Foundation of Contract Law (CLF)

A BILL To _____________ Establish the foundation of Contract Law The people of Democracy Craft, through their elected representatives in the Congress and the force of law ordained to that Congress by the people through the constitution, do hereby enact the following provisions into law: 1...

Evidence B

Act of Congress - Corporate Law and Shareholder Protections Act

A BILL TO Establish Corporate Law and Shareholder Protections The people of Democracy Craft, through their elected Representatives in the Congress and the force of law ordained to that Congress by the people through the constitution, do hereby enact the following provisions into law: 1 -...

Proof of Representation.