Omegabiebel

Citizen

Senator

Supporter

Oakridge Resident

5th Anniversary

Grave Digger

Change Maker

Statesman

Omegabiebel

Senator

- Joined

- Aug 6, 2023

- Messages

- 174

- Thread Author

- #1

Case Filing

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Volt Bank, Inc.

Plaintiff

v.

.AstuteSundew823 (Kakintus/Mikhail Kaukin/Abadoniss)

Defendant

COMPLAINT

The Plaintiff complains against the Defendants as follows:

The Defendant defaulted on a line of credit agreement with the Plaintiff, having withdrawn $291,000 to purchase real estate collateral that is now worth significantly less than the outstanding debt, constituting Breach of Contract.

I. PARTIES

1. Volt Bank, Inc.2. .AstuteSundew823 (aka Kakintus, Mikhail Kaukin, and Abadoniss)

II. FACTS

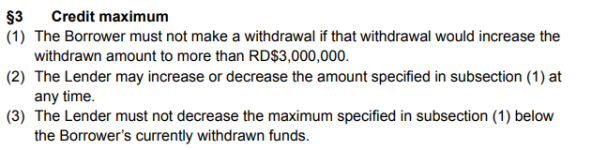

1. On 26 October 2025, the Defendant executed a Line of Credit Agreement with Volt Bank. (P-001)2. Under the LOC Agreement, Volt Bank extended a line of credit to the Defendant with a maximum withdrawal amount of $3,000,000, subject to the terms and conditions of the agreement. (P-002)

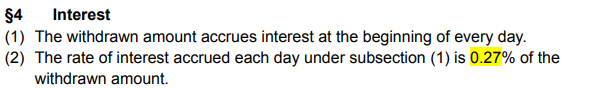

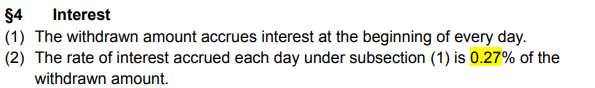

3. Section 4(2) of the LOC Agreement provides that withdrawn amounts accrue interest at a rate of 0.27% per day. (P-003)

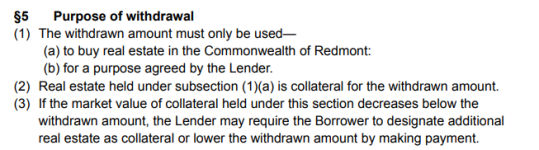

4. Section 5(1) of the LOC Agreement restricts the use of withdrawn funds, stating: "The withdrawn amount must only be used—(a) to buy real estate in the Commonwealth of Redmont; (b) for a purpose agreed by the Lender." (P-004)

5. Section 5(2) provides that "Real estate held under subsection (1)(a) is collateral for the withdrawn amount." (P-004)

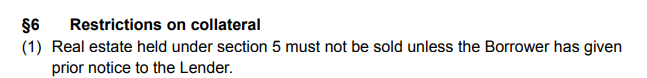

6. Section 6(1) prohibits the sale of collateral: "Real estate held under section 5 must not be sold unless the Borrower has given prior notice to the Lender." (P-005)

7. Between 4 November 2025 and 5 November 2025, the Defendant made multiple withdrawal requests under the LOC Agreement, which Volt Bank approved:

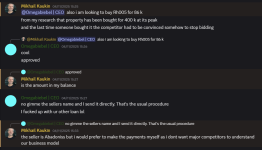

a. 4 November 2025: Plot RH005 for $86,000 (P-006)

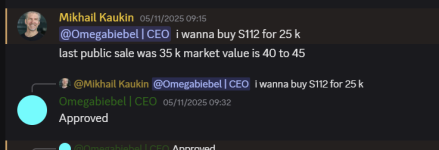

b. 5 November 2025: Plot S112 for $25,000 (P-007)

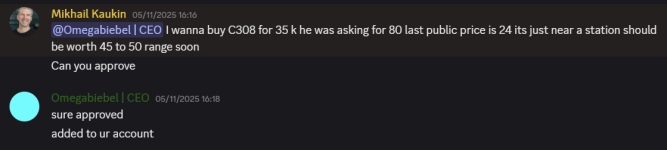

c. 5 November 2025: Plot C308 for $35,000 (P-008)

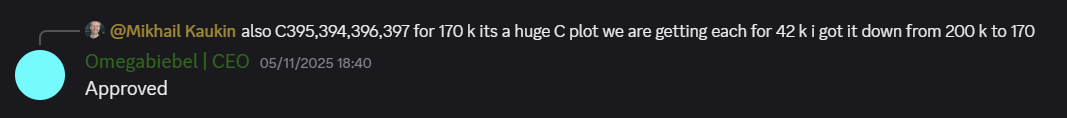

d. 5 November 2025: Plots C395, C394, C396, C397 for a total of approximately $170,000 (P-009)

8. The total amount withdrawn by the Defendant under the LOC Agreement was approximately $291,000.

9. The Defendant used the withdrawn funds to purchase the real estate plots specified above (C394, C395, C396, C397, C308, S112, and RH005), which became collateral under Section 5(2) of the LOC Agreement. (P-004)

10. The Defendant has been permanently deported from the Commonwealth of Redmont. (P-010)

11. As a result of the Defendant's deportation, the Defendant is unable to repay the withdrawn amount.

12. On or around 6 November 2025, Volt Bank commissioned an independent valuation of the collateral plots from JediAJMan, an independent plot valuator. (P-011)

13. The valuation determined that the total market value of the collateral plots (C394, C395, C396, C397, C308, S112, and RH005) is between $145,000 and $165,000. (P-011)

14. The collateral is therefore insufficient to satisfy the outstanding debt of $291,000, resulting in a deficiency of approximately $126,000 to $146,000.

15. The Defendant has failed to repay any portion of the withdrawn amount and has defaulted under the LOC Agreement.

16. Under Section 7(1) of the LOC Agreement, Volt Bank has the right to require the Borrower to pay the withdrawn amount within 5 days at any time. (P-012)

17. Under Section 7(2)(a), the Lender may declare the Borrower in default if the Borrower "does not comply with subsection (1)." (P-012)

18. Under Section 7(3), upon declaring default, "the Lender may seize any collateral held by the Borrower." (P-012)

III. CLAIMS FOR RELIEF

1. BREACH OF CONTRACT

Section 7 of the Contracts Act states:The Defendant breached the Line of Credit Agreement under Section 7 of the Contracts Act by failing to repay the withdrawn amount of $291,000 despite Volt Bank's demand for payment.7 - Breach of Contract

(1) A breach of contract occurs when a party fails to fulfil its contractual obligations.

(a) Remedies for breach may include damages, specific performance, or other equitable relief.

- Under Section 7(3) of the LOC Agreement, Volt Bank is entitled to seize all collateral held by the Borrower upon default.

- Under Section 7(4) of the LOC Agreement: "if the proceeds of the sale are less than the withdrawn amount, the Borrower remains liable for the unpaid amount."

- Under Section 7(6), nothing in the default provisions affects Volt Bank's right to "damages of any type, including punitive damages; or any other relief that the Lender may have under the laws of the Commonwealth of Redmont."

IV. PRAYER FOR RELIEF

The Plaintiff respectfully requests that this Court grant the following relief:1. A Court Order immediately transferring ownership of all collateral plots to Volt Bank, including: C394, C395, C396, C397, C308, S112, and RH005, pursuant to Section 7(3) of the LOC Agreement.

2. A Court Order transferring ownership of plot C655 from the Defendant to Volt Bank as partial satisfaction of the outstanding debt.

3. A Court Order transferring all remaining assets, plots, properties, bank accounts, items, and property of any kind owned by AstuteSundew823 and/or held by Abadoniss or any other alt accounts, on behalf of AstuteSundew823 to Volt Bank, Inc., to satisfy the remaining outstanding debt.

4. $291,000 in Compensatory Damages (less the value of any assets transferred under paragraphs 1-3 above) for the outstanding principal amount withdrawn under the LOC Agreement, pursuant to Legal Damages Act Section 4.

5. Compensatory Damages for all accrued interest at the rate of 0.27% per day from the date of each withdrawal through the date of judgment, pursuant to Legal Damages Act Section 4.

6. 30% Legal Fees pursuant to Legal Damages Act Section 9.

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 21st day of November 2025

Motion

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

MOTION FOR DEFAULT JUDGEMENT

The Defendant has been permanently banned. Plaintiff requests default judgment on all prayers for relief.

Attachments

-

LOC Agreement.pdf297.9 KB · Views: 4

-

P-001.png41.4 KB · Views: 6

P-001.png41.4 KB · Views: 6 -

P-002.png22.2 KB · Views: 5

P-002.png22.2 KB · Views: 5 -

P-003.png22.2 KB · Views: 4

P-003.png22.2 KB · Views: 4 -

P-004.png54.4 KB · Views: 5

P-004.png54.4 KB · Views: 5 -

P-005.png16.6 KB · Views: 4

P-005.png16.6 KB · Views: 4 -

P-006.png136.1 KB · Views: 3

P-006.png136.1 KB · Views: 3 -

P-007.png47.1 KB · Views: 3

P-007.png47.1 KB · Views: 3 -

P-008.png47 KB · Views: 3

P-008.png47 KB · Views: 3 -

P-009.png24.7 KB · Views: 3

P-009.png24.7 KB · Views: 3 -

P-010.png118.2 KB · Views: 4

P-010.png118.2 KB · Views: 4 -

P-011.png67.9 KB · Views: 4

P-011.png67.9 KB · Views: 4 -

P-012.png157.4 KB · Views: 6

P-012.png157.4 KB · Views: 6

Last edited: