Lord_Donuticus

Citizen

Supporter

Grave Digger

3rd Anniversary

Legal Eagle

Change Maker

1st Anniversary

Statesman

Popular in the Polls

The_Donuticus

Attorney

- Joined

- Feb 16, 2021

- Messages

- 248

- Thread Author

- #1

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Unfairly Taxed Citizens Class Action Lawsuit Group (DouCo Law & Partners Representing)

Plaintiff

v.

The Commonwealth of Redmont

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

Your Honor,

We have laws for a reason, they exist and must be followed. One of DouCo Law & Partners clients, Milqy, has come to us to represent them in the fact they have been illegally taxed for the plots that they own. The Taxation Act specifically outlines: “8 - Terms of Property Taxation: ...

(2) Plot taxes only apply to the City of Hamilton, unless otherwise provided by Local Governments.” - Only apply to the City of Hamilton. We are not in the City of Hamilton anymore, we are in the City of Reveille and thus any plot taxes charged there are illegal and must be returned.

In understanding that after this revelation a great many citizens will be wanting to get their money back, DouCo Law & Partners has established, to its knowledge, the servers first Class Action Lawsuit Group. Rather than every citizen making their own lawsuit thus clogging up the court, they may contact DouCo Law & Partners to be included as a Plaintiff in this case. There is precedent for a group of citizens to appear as the Plaintiff in a case (Lawsuit: In Session - Corporate Security Union v. Commonwealth of Redmont [2022] SCR 15) and also for additional claims for relief, in this instance another instance of illegal taxation, to be introduced mid-suit, thus the Plaintiff sees no reason why the courts would not allow this very effective time saving measure and would ask the Court if they would liked to be informed every time a new member joins the Class Action Lawsuit Group or should the Plaintiff just update the list provided below? Furthermore would the court like to impose a limit on when new members can join the Class Action Lawsuit Group, such as after Opening Statements, or can new members join until the case is concluded.

Furthermore due to the unique nature of this case the Plaintiff will require an extended period of discovery with the DEC after opening statements in order to ascertain the full extent of damages done in terms of illegally obtained taxation.

I. PARTIES

1. Unfairly Taxed Citizens Class Action Group

2. The Commonwealth of Redmont

II. FACTS

1. On January 1st 2020 Congress passed the Taxation Act, outlining the rules for Plot Taxes as only applying to the ‘City of Hamilton’.

2. In December of 2021 the population of Redmont began the process of migrating to a new City ‘Reveille’.

3. Plot Taxes have been charged for this 'City of Reveille', despite no legal right for this. This is due to Government oversight and negligence.

III. CLAIMS FOR RELIEF

1. The Government had no legal right to take these taxes and thus must return them immediately.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. The return of all illegally seized plot taxes to all members of the Unfairly Taxed Citizens Class Action Group.

2. An extra award of 20% of the value of illegally seized plot taxes to all members of the Unfairly Taxed Citizens Class Action Group, to cover legal fees & as compensation.

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 5th day of October 2022

CIVIL ACTION

Unfairly Taxed Citizens Class Action Lawsuit Group (DouCo Law & Partners Representing)

Plaintiff

v.

The Commonwealth of Redmont

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

Your Honor,

We have laws for a reason, they exist and must be followed. One of DouCo Law & Partners clients, Milqy, has come to us to represent them in the fact they have been illegally taxed for the plots that they own. The Taxation Act specifically outlines: “8 - Terms of Property Taxation: ...

(2) Plot taxes only apply to the City of Hamilton, unless otherwise provided by Local Governments.” - Only apply to the City of Hamilton. We are not in the City of Hamilton anymore, we are in the City of Reveille and thus any plot taxes charged there are illegal and must be returned.

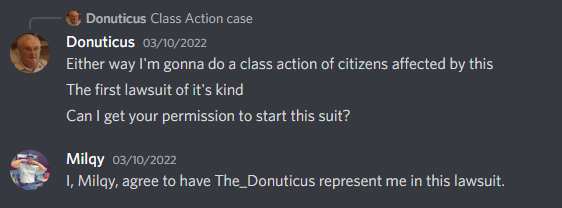

In understanding that after this revelation a great many citizens will be wanting to get their money back, DouCo Law & Partners has established, to its knowledge, the servers first Class Action Lawsuit Group. Rather than every citizen making their own lawsuit thus clogging up the court, they may contact DouCo Law & Partners to be included as a Plaintiff in this case. There is precedent for a group of citizens to appear as the Plaintiff in a case (Lawsuit: In Session - Corporate Security Union v. Commonwealth of Redmont [2022] SCR 15) and also for additional claims for relief, in this instance another instance of illegal taxation, to be introduced mid-suit, thus the Plaintiff sees no reason why the courts would not allow this very effective time saving measure and would ask the Court if they would liked to be informed every time a new member joins the Class Action Lawsuit Group or should the Plaintiff just update the list provided below? Furthermore would the court like to impose a limit on when new members can join the Class Action Lawsuit Group, such as after Opening Statements, or can new members join until the case is concluded.

Furthermore due to the unique nature of this case the Plaintiff will require an extended period of discovery with the DEC after opening statements in order to ascertain the full extent of damages done in terms of illegally obtained taxation.

I. PARTIES

1. Unfairly Taxed Citizens Class Action Group

Milqy

Aladeen22

deadwax

Bombaz2005

ElainaThomas29

Gertis7

Aladeen22

deadwax

Bombaz2005

ElainaThomas29

Gertis7

II. FACTS

1. On January 1st 2020 Congress passed the Taxation Act, outlining the rules for Plot Taxes as only applying to the ‘City of Hamilton’.

2. In December of 2021 the population of Redmont began the process of migrating to a new City ‘Reveille’.

3. Plot Taxes have been charged for this 'City of Reveille', despite no legal right for this. This is due to Government oversight and negligence.

III. CLAIMS FOR RELIEF

1. The Government had no legal right to take these taxes and thus must return them immediately.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

1. The return of all illegally seized plot taxes to all members of the Unfairly Taxed Citizens Class Action Group.

2. An extra award of 20% of the value of illegally seized plot taxes to all members of the Unfairly Taxed Citizens Class Action Group, to cover legal fees & as compensation.

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 5th day of October 2022

Last edited: