Superwoops

Citizen

Public Defender

Justice Department

Oakridge Resident

5th Anniversary

Change Maker

Superwoops

Public Defender

- Joined

- Jan 3, 2025

- Messages

- 117

- Thread Author

- #1

Case Filing

IN THE FEDERAL COURT OF THE COMMONWEALTH OF REDMONT

CIVIL ACTION

Superwoops

Plaintiff

v.

Red Nose Capital

Defendant

COMPLAINT

The Plaintiff complains against the Defendant as follows:

Red Nose Capital has engaged in unfair business practices which led me to invest $29,600 into an ETF with extremely deficient accounting practices and almost nonexistent compliance.

I. PARTIES

1. Superwoops (Plaintiff)

2. Red Nose Capital (Defendant)

3. Sagamo2008 (CEO and owner of the Defendant)

II. FACTS

- Superwoops opened a ticket in the Red Nose Capital server with the intention of buying shares of its ETF, named Red Nose Hypercapital Fund (RNHC).

- Red Nose Capital (RNC) is not a registered LLC.

- Sagamo2008 is the CEO of RNC. (P-005)

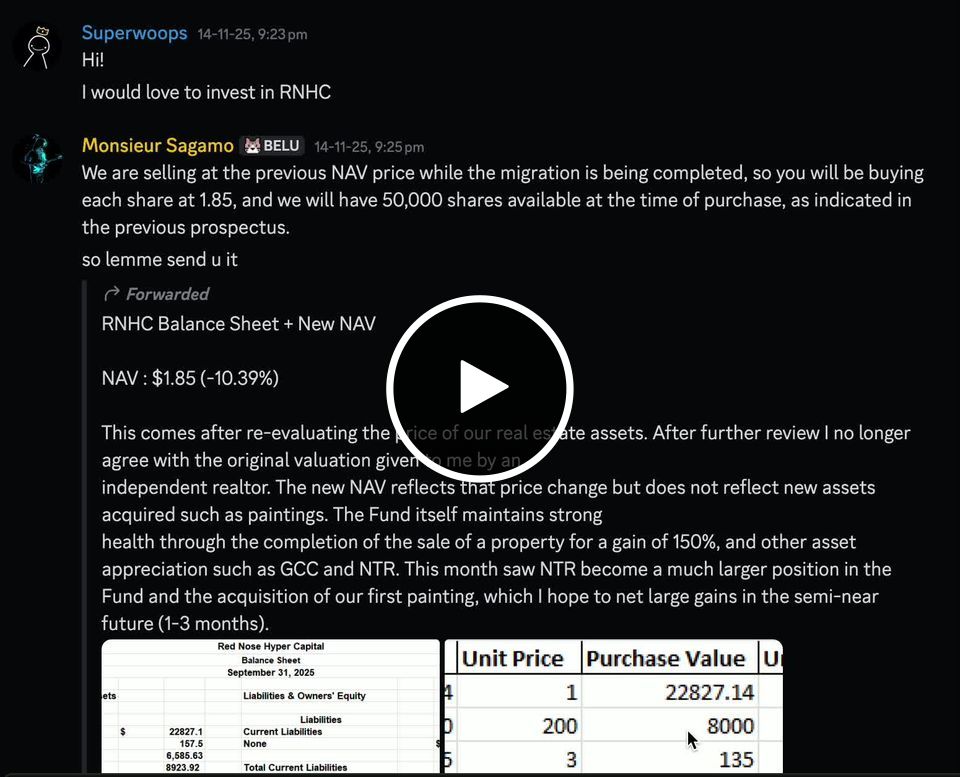

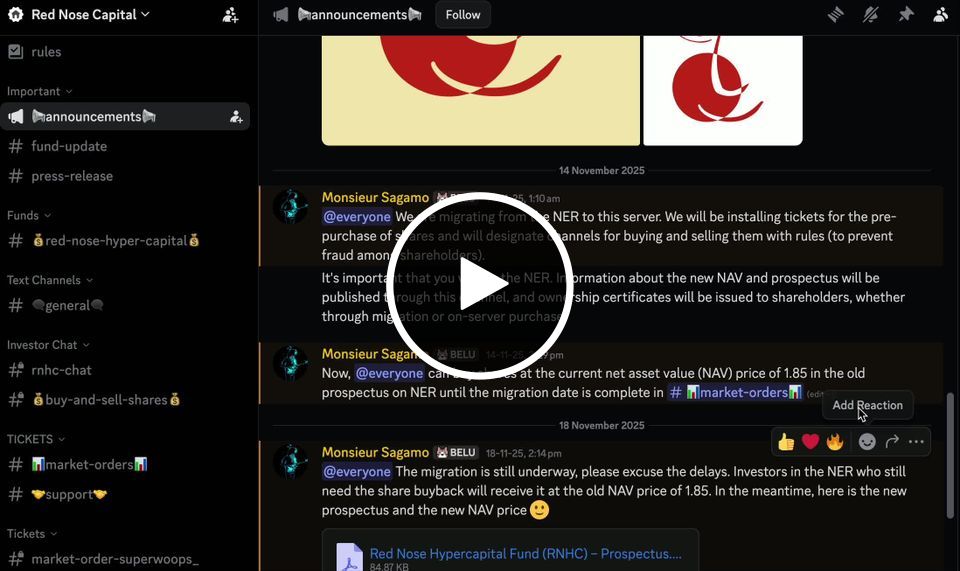

- Sagamo2008 told Superwoops that RNHC was in the process of migrating from the National Exchange of Redmont to an in-house trading system

- The Plaintiff asked whether RNC was registered with the Department of Commerce as an Investment Bank, to which the Defendant replied with “Yes”

- RNC was never registered with the Department of Commerce as an Investment Bank.

- Companies not registered as Investment Banks may not invest for customers.

- Worried about compliance and in relation to the fund’s legal status as an ETF, Superwoops made the following statement “I have just one final worry, because you're transitioning from NER into in-house trading of the shares, and the prosupectus [sic.] states that: ‘Shares may be repurchased on the open market’ But as per regulations, only businesses registered as exchanges can sell securities publicly so that's my main worry, although I might be missing something”

- The Defendant replied with “I know that's what the prospectus says, but as I mentioned, we're doing everything possible to avoid trading through a broker. The previous administration put the fund into a public market, and the mistake was that the shares were fully subscribed and, without any demand, the market price plummeted, though not the NAV. Meanwhile, in the domestic market, we can offer a price closer to the NAV so that the price of each share isn't diluted by supply and demand, while also maintaining trading controlled by the new regulations that will be in place within two days. The rules are not included in the prospectus, but they are set out on the server for the regulation of the same actions.”

- The Plaintiff, upon being reassured of the compliance of the ETF, or appearance of, purchased 16,000 shares at $1.85 a share, totaling $29,600. This created a legal contract, its terms laid out in the Prospectus and in the Certificate of Ownership. The ownership stake of Superwoops in the overall fund is 16%.

- The Certificate of Ownership appears to award Superwoops voting rights in the supposed LLC in accordance with the Legal Entity Act.

- RNC is not an LLC, and therefore Superwoops is not legally entitled to voting rights.

- The Defendant filed the first monthly report after the migration on the 18th of November, showing healthy profits for the fund with a new value per share of $2.09, meaning that the Plaintiff’s investment was now worth $33,440.

- The November 18th report was the last report filed. No report was filed for December 18th.

- There existed an expectation of regular, timely monthly reports of the financial health of the fund.

- The Plaintiff has multiple times asked and pinged the Defendant on the RNC Discord server.

- The Commercial Standards Act states that “An ETF combines the traits of a publicly traded security and a managed investment fund, allowing investors to collectively own portions of the fund while retaining the ability to buy or sell those portions through a registered Stock Exchange.”

- Red Nose Capital is not a registered Stock Exchange.

- The Defendant knowingly stated to the Plaintiff that the migration of the ETF into an internally-traded one would maintain “trading controlled by the new regulations”, which is false.

- Following the migration, the Defendant never submitted to the RNC Discord server what would have been required under §14(1)(b)(i), §14(1)(b)(ii), §14(1)(b)(iii), §14(1)(b)(iv), §14(1)(b)(v) or §14(1)(b)(vi) of the Commercial Standards Act, relating to companies running ETFs.

- The Defendant submitted to the RNC Discord server the document that would have been required under §14(1)(a), but not in the manner prescribed by §14(3) of the Commercial Standards Act. Sagamo2008 does not hold an accounting license, and he is the one that submitted the document.

- The Defendant never submitted any of the above stated documents to the stock exchange the ETF is listed on as required by §14(2) of the Commercial Standards Act because the ETF was never listed on a stock exchange to begin with.

- The Prospectus of the ETF states that “RNHC seeks exponential asset growth by leveraging a wide variety of dynamic and high-yield opportunities. Its philosophy is that all legal avenues are open to maximize returns”.

III. CLAIMS FOR RELIEF

Superwoops and Red Nose Capital entered a contract when the purchase of shares of the ETF happened. This contract stipulated that “[RNHC’s] philosophy is that all legal avenues are open to maximize returns”. By not following several provisions of the Commercial Standards Act (§14(1)(b)(i), §14(1)(b)(ii), §14(1)(b)(iii), §14(1)(b)(iv), §14(1)(b)(v), §14(1)(b)(vi), §14(2) and §14(3)) RNC appears to have violated the law. It has not taken fully legal avenues as promised by the Prospectus and has thus breached the contract. According to the CSA, remedies for breach may include damages, specific performance, or other equitable relief. Red Nose Capital also subsequently did not follow the values and principles set out in §9(14)(b), §9(14)(c)(i)(1), and §9(14)(c)(i)(3) of the Legal Entity Act. Furthermore, voting rights were not awarded to the Plaintiff because they legally couldn't be- RNC is a sole proprietorship.

Furthermore, the CEO of Red Nose Capital is not responding to messages and has not posted an update to investors as promised by the Prospectus: “Shareholders receive detailed updates on every trade and investment. Platform: All information is posted on the Red Nose Capital Discord server.” This is another breach of contract.

The Commercial Standards Act states that False Advertisement is a commercial advertisement that contains untrue information, that would deceive the reasonable person. The advertiser must have acted knowingly. If the information is publicly accessible, it may be presumed that the advertiser was aware of it. Similar damages were granted in Lawsuit: Adjourned - MegaMinerM v. Blazora Corporation [2025] FCR 27.

The Contracts Act states that misrepresentation happens when a false statement induces another party to enter into a contract. Remedies for misrepresentation may include rescission, damages, or other appropriate relief. Similar damages were granted in Lawsuit: Adjourned - MegaMinerM v. Blazora Corporation [2025] FCR 27.

Fraud is defined by the Criminal Code Act as “knowingly or recklessly misrepresents or omits a material fact to another, causing the other party to rely on that misrepresentation, resulting in actual, quantifiable harm.” Similar damages were granted in Lawsuit: Adjourned - MegaMinerM v. Blazora Corporation [2025] FCR 27.

Furthermore, the CEO of Red Nose Capital is not responding to messages and has not posted an update to investors as promised by the Prospectus: “Shareholders receive detailed updates on every trade and investment. Platform: All information is posted on the Red Nose Capital Discord server.” This is another breach of contract.

The Commercial Standards Act states that False Advertisement is a commercial advertisement that contains untrue information, that would deceive the reasonable person. The advertiser must have acted knowingly. If the information is publicly accessible, it may be presumed that the advertiser was aware of it. Similar damages were granted in Lawsuit: Adjourned - MegaMinerM v. Blazora Corporation [2025] FCR 27.

The Contracts Act states that misrepresentation happens when a false statement induces another party to enter into a contract. Remedies for misrepresentation may include rescission, damages, or other appropriate relief. Similar damages were granted in Lawsuit: Adjourned - MegaMinerM v. Blazora Corporation [2025] FCR 27.

Fraud is defined by the Criminal Code Act as “knowingly or recklessly misrepresents or omits a material fact to another, causing the other party to rely on that misrepresentation, resulting in actual, quantifiable harm.” Similar damages were granted in Lawsuit: Adjourned - MegaMinerM v. Blazora Corporation [2025] FCR 27.

IV. PRAYER FOR RELIEF

The Plaintiff seeks the following from the Defendant:

- $33,467.45 in compensatory damages, corresponding to 16% of the total Net Assets Attributable to Owners in the most recent balance sheet. This is the value of the shares held in the Plaintiff’s name.

- $50,000 in punitive damages for breach of contract for violating several provisions of the Commercial Standards Act and for illicitly investing for third parties when said action is strictly forbidden, as RNC was not an Investment Bank. The contract both explicitly and implicitly stated that all dealings would be made in a legal manner. As a shareholder of the ETF, the Plaintiff was entitled to the safeguards provided in the CSA for transparency of any and all transactions and decisions by the CEO. The CEO broke that promise in a reckless disregard of the law and of the Plaintiff’s contractual rights and constitutes outrageous conduct by the recipient of the Plaintiff’s trust, Red Nose Capital.

- $10,000 in punitive damages for breach of contract for the CEO’s reckless disappearance. In another case (Lawsuit: Adjourned - ItsBlazeX v. Atreides [2024] FCR 84), the Court ruled that the manager should have come up with safeguards to prevent harm to investors were this to happen.

- $10,000 in punitive damages for false advertising. Red Nose Capital sold the Plaintiff an ETF only in name. This ETF was non-compliant with the law, not meeting the threshold of being listed on a registered exchange and therefore not truly an ETF despite being advertised on their Discord server publicly as such. Also, Red Nose Capital was never an LLC, an aspect deeply important due to asset management and liability reasons.

- $15,000 in punitive damages for misrepresentation. Even having inquired as to a supposed breach of the Commercial Standards Act, the Defendant doubled down on their claims, alleging their actions were legitimate. The Plaintiff relied on this reassurance to sign the contract and purchase the shares, therefore constituting misrepresentation.

- $20,000 in punitive damages for fraud. The misrepresentation presented above induced the Plaintiff to enter a contract with the Defendant, suffering a clear injury– the investment of $29,600 into a business engaging in malicious accounting practices. The Plaintiff could have better used those funds, which are now retained in Red Nose Capital and blocked from withdrawal due to the CEO’s disappearance.

- $10,000 in punitive damages for outrageous conduct violating the very principles of fiduciary duty and the implied covenant of good faith and fair dealing by knowingly proposing a transaction that was unfair towards the receiver and dishonestly both lying and withholding several pieces of information in the process of formation of the contract.

- $44,540.24 in legal fees, corresponding to 30% of the case value, payable to Superwoops.

V. EVIDENCE

See PDF (PROSPECTUS)

See PDF (LATEST BALANCE SHEET)

By making this submission, I agree I understand the penalties of lying in court and the fact that I am subject to perjury should I knowingly make a false statement in court.

DATED: This 21st day of December 2025.

Attachments

Last edited: