End

Owner

Owner

Representative

Construction & Transport Department

Education Department

Interior Department

Redmont Bar Assoc.

Supporter

Willow Resident

xEndeavour

constructor

- Joined

- Apr 7, 2020

- Messages

- 2,119

- Thread Author

- #1

A

BILL

To

Introduce taxation for Industrial, Residential, and Commercial plots and deter tax evasion.

1 - Short Title and Enactment

(1) This Act may be cited as the "Taxation Amendment Act”.

(2) This law takes effect immediately after its signature and after the plugin has been added to the Server.

(3) This bill was written by Representative, ReinausPrinzzip in collaboration with The Deputy Speaker of the House, xEndeavour.

(4) Co-sponsored by: ReinausPrinzzip

2 - Reasons

(1) Plots are used to evade taxes

(2) These tax rates will override Executive-mandated taxes

(3) Plot taxation may result in a reduction of the balance tax.

(5) Massive tax cuts

3 - Plot Taxation Brackets

The owner of a Commercial, Industrial, and or Residential plot (as defined in /as info) will be subject to a monthly plot tax, as determined by Congress and as allocated by the DEC.

(1) Commercial

Value for tax for each region in Hamilton:

Low - $3.33/1 Day

Medium - $6.66/1 Day

High - $10/1 Day

(2) Industrial

Flat Rate: $6.66/1 Day

(3) Residential

Flat rate: $3.33/1 Day

4 - Terms

(1) This bill will amend the Taxation Act.

(2) The DEC will be responsible for allocating plots to the above brackets. A guide has been provided to the DEC to guide them in allocating plots to brackets, but is not mandated. e.g. Large plots may need adjusted tax brackets if they fall into allow bracket.

(3) Plot taxes only apply to the City of Hamilton, unless otherwise provided by Local Governments.

(4) Towns may request for the Federal Government to conduct plot taxation, where the Federal Government will then provide the taxed amount to the Town on the first day of every month.

(5) Assigning a higher bracket punitively or lowering a bracket for personal benefit is considered corruption.

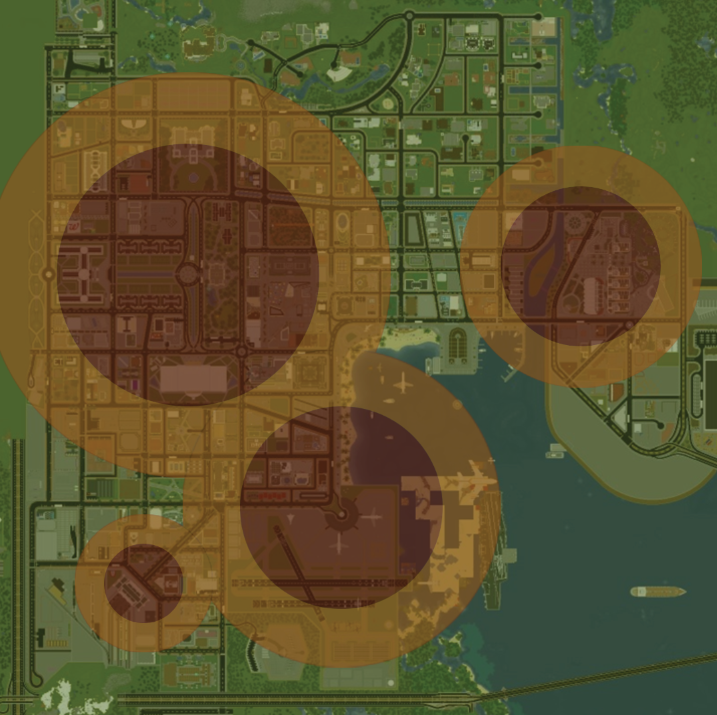

5 - Taxation Bracket Guide

6 - Tax Bracket Changes

(1) Subsection a is changed to subsection b.

a. (1) Personal balances between $0.00 and $2,499.99 (inclusive) shall be taxed at a rate between 0.00% and 0.10% daily, at the discretion of the DEC.

(2) Personal balances between $2,500.00 and $4,999.99 (inclusive) shall be taxed at a rate between 0.10% and 0.15% daily, at the discretion of the DEC.

(3) Personal balances between $5,000.00 and $9,999.99 (inclusive) shall be taxed at a rate between 0.15% and 0.20% daily, at the discretion of the DEC.

(4) Personal balances between $10,000.00 and $24,999.99 (inclusive) shall be taxed at a rate between 0.20% and 0.40% daily, at the discretion of the DEC.

(5) Personal balances between $25,000.00 and $49,999.99 (inclusive) shall be taxed at a rate between 0.40% and 0.50% daily, at the discretion of the DEC.

(6) Personal balances between $50,000.00 and $99,999.99 (inclusive) shall be taxed at a rate between 0.50% and 0.60% daily, at the discretion of the DEC.

(7) Personal balances of at least $100,000.00 shall be taxed at a rate of 0.60% daily.

(8) The set rate must be consistent for all individuals of the same wealth bracket and may not vary by person.

b. (1) Personal balances between the given brackets (inclusive) shall be taxed at the following rates.

- 0.000% ($0 - $2499) max. $0/day

- 0.005% ($2,500 - $9,999) max. $49.99/day

- 0.005% ($10,000 - $49,999) max. $249.99/day

- 0.005% ($50,000 - $99,999) max. $499.99/day

- 0.005% ($100,000 - $199,999) max. $999.99/day

- 0.010% ($200,000+) min. $2000/day

(2) The set rate must be consistent for all individuals of the same wealth bracket and may not vary by person.

7 - UBI

Universal Basic Income is lowered to $2.50/15 minutes to assist in reducing the $180,000 Government deficit.

BILL

To

Introduce taxation for Industrial, Residential, and Commercial plots and deter tax evasion.

1 - Short Title and Enactment

(1) This Act may be cited as the "Taxation Amendment Act”.

(2) This law takes effect immediately after its signature and after the plugin has been added to the Server.

(3) This bill was written by Representative, ReinausPrinzzip in collaboration with The Deputy Speaker of the House, xEndeavour.

(4) Co-sponsored by: ReinausPrinzzip

2 - Reasons

(1) Plots are used to evade taxes

(2) These tax rates will override Executive-mandated taxes

(3) Plot taxation may result in a reduction of the balance tax.

(5) Massive tax cuts

3 - Plot Taxation Brackets

The owner of a Commercial, Industrial, and or Residential plot (as defined in /as info) will be subject to a monthly plot tax, as determined by Congress and as allocated by the DEC.

(1) Commercial

Value for tax for each region in Hamilton:

Low - $3.33/1 Day

Medium - $6.66/1 Day

High - $10/1 Day

(2) Industrial

Flat Rate: $6.66/1 Day

(3) Residential

Flat rate: $3.33/1 Day

4 - Terms

(1) This bill will amend the Taxation Act.

(2) The DEC will be responsible for allocating plots to the above brackets. A guide has been provided to the DEC to guide them in allocating plots to brackets, but is not mandated. e.g. Large plots may need adjusted tax brackets if they fall into allow bracket.

(3) Plot taxes only apply to the City of Hamilton, unless otherwise provided by Local Governments.

(4) Towns may request for the Federal Government to conduct plot taxation, where the Federal Government will then provide the taxed amount to the Town on the first day of every month.

(5) Assigning a higher bracket punitively or lowering a bracket for personal benefit is considered corruption.

5 - Taxation Bracket Guide

6 - Tax Bracket Changes

(1) Subsection a is changed to subsection b.

a. (1) Personal balances between $0.00 and $2,499.99 (inclusive) shall be taxed at a rate between 0.00% and 0.10% daily, at the discretion of the DEC.

(2) Personal balances between $2,500.00 and $4,999.99 (inclusive) shall be taxed at a rate between 0.10% and 0.15% daily, at the discretion of the DEC.

(3) Personal balances between $5,000.00 and $9,999.99 (inclusive) shall be taxed at a rate between 0.15% and 0.20% daily, at the discretion of the DEC.

(4) Personal balances between $10,000.00 and $24,999.99 (inclusive) shall be taxed at a rate between 0.20% and 0.40% daily, at the discretion of the DEC.

(5) Personal balances between $25,000.00 and $49,999.99 (inclusive) shall be taxed at a rate between 0.40% and 0.50% daily, at the discretion of the DEC.

(6) Personal balances between $50,000.00 and $99,999.99 (inclusive) shall be taxed at a rate between 0.50% and 0.60% daily, at the discretion of the DEC.

(7) Personal balances of at least $100,000.00 shall be taxed at a rate of 0.60% daily.

(8) The set rate must be consistent for all individuals of the same wealth bracket and may not vary by person.

b. (1) Personal balances between the given brackets (inclusive) shall be taxed at the following rates.

- 0.000% ($0 - $2499) max. $0/day

- 0.005% ($2,500 - $9,999) max. $49.99/day

- 0.005% ($10,000 - $49,999) max. $249.99/day

- 0.005% ($50,000 - $99,999) max. $499.99/day

- 0.005% ($100,000 - $199,999) max. $999.99/day

- 0.010% ($200,000+) min. $2000/day

(2) The set rate must be consistent for all individuals of the same wealth bracket and may not vary by person.

7 - UBI

Universal Basic Income is lowered to $2.50/15 minutes to assist in reducing the $180,000 Government deficit.

Last edited: